mississippi state income tax rate 2021

Tim Bjur is an attorney and senior content management analyst for Wolters Kluwer Tax Accounting who has spent the last 18 years analyzing state income tax legislation case law and regulatory developments. The map is interactive and you can hover over any US state to see the rate or range of.

States With The Highest And Lowest Property Taxes Property Tax States High Low

The state supplemental income tax withholding rates currently available for 2022 are shown in the chart below.

. Find your gross income 4. The state supplemental income tax withholding rates currently available for 2021 are shown in the chart below. In April 2021 New Yorks highest tax rate changed with the passage of the 20212022 budget.

State Rates Brackets Rates Brackets Single Couple Single Couple Dependent. You can try it free. The chart also shows if the state has a flat tax rate meaning only one rate of tax applies regardless of the wages paid or alternatively the highest marginal withholding rate according to the states latest computer withholding formula.

Rates range from 25 percent in North Carolina to 115 percent in New Jersey. Texas state income tax rate for 2021 is 0 because Texas does not collect a personal income tax. The 2022 state personal income tax brackets are updated from the Maine and Tax Foundation data.

Before the official 2022 Maine income tax rates are released provisional 2022 tax rates are based on Maines 2021 income tax brackets. Outlook for the 2019 Texas income tax rate is to remain unchanged at 0. If you want to automate payroll tax calculations you can download in-house ezPaycheck payroll software which can calculate federal tax state tax Medicare tax Social Security Tax and other taxes for you automatically.

Calculate your state income tax step by step 6. Maines maximum marginal income tax rate is the 1st highest in the United States. The top marginal individual income tax rate was permanently increased from 49 to 59 with the addition of a new bracket.

Individual Income Tax Structure by State 2021 No Tax Single-rate Graduated-rate Alaska Colorado Alabama Florida Illinois Arizona Nevada Indiana Arkansas South Dakota Kentucky California Tennessee Massachusetts Connecticut Texas Michigan Delaware Washington New Hampshire Georgia Wyoming North Carolina Hawaii Pennsylvania Idaho Utah Iowa Kansas. The Mississippi tax rate and tax brackets are unchanged from last year. Check the state tax rate and the rules to calculate state income tax 5.

The state income tax rate can and will play a role in how much tax you will pay on your income. Before the official 2022 Mississippi income tax rates are released provisional 2022 tax rates are based on Mississippis 2021 income tax brackets. Texas income tax rate and tax brackets shown in the table below are based on income earned between January 1 2021 through December 31 2021.

According to the Mississippi Department of Revenue people with incomes of at least 100000 a year make up 14 of those who pay state income tax and their payments bring in 56 of the income tax. The previous 882 rate was increased to three graduated rates of 965 103 and 109. Mississippi state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with MS tax rates of 0 3 4 and 5 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses.

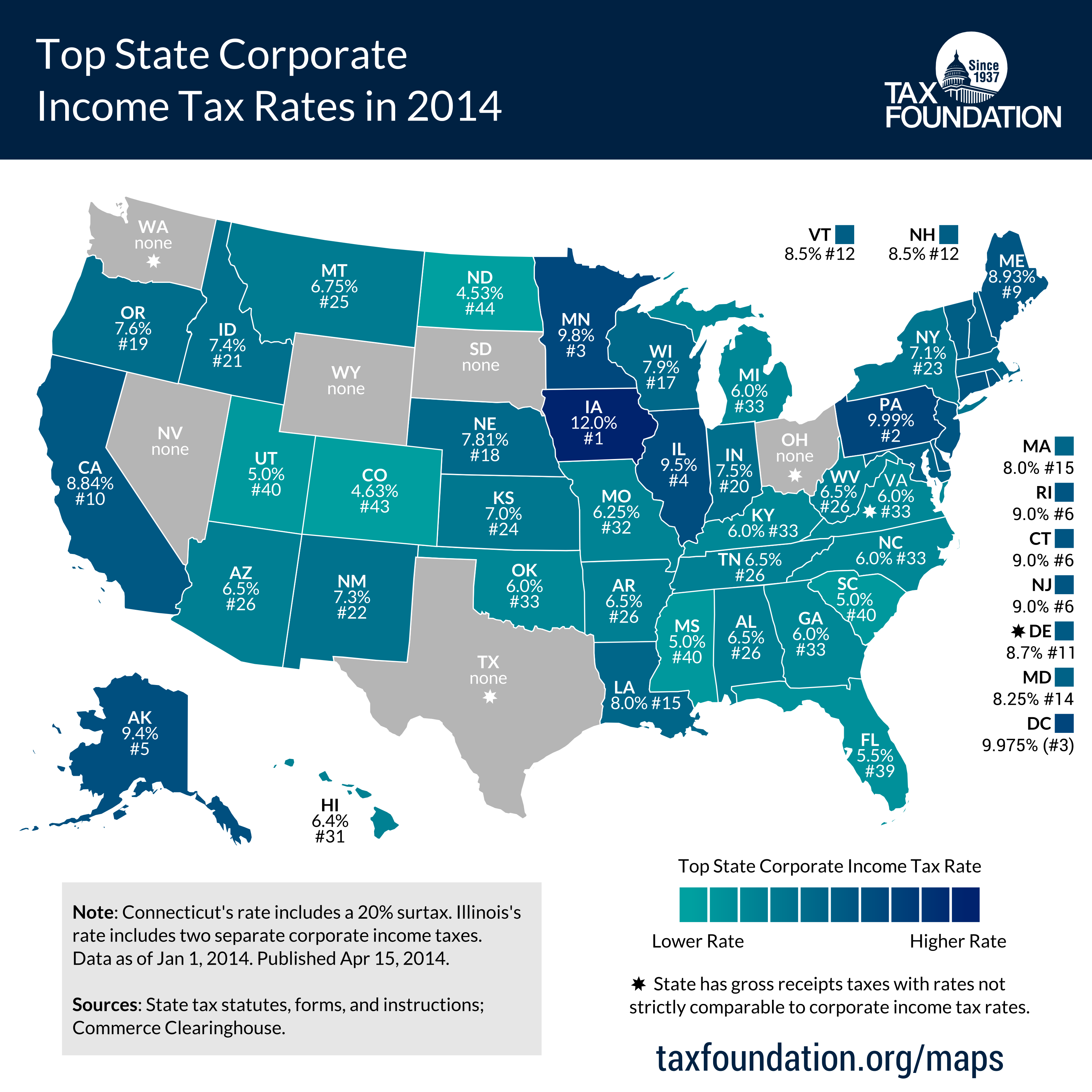

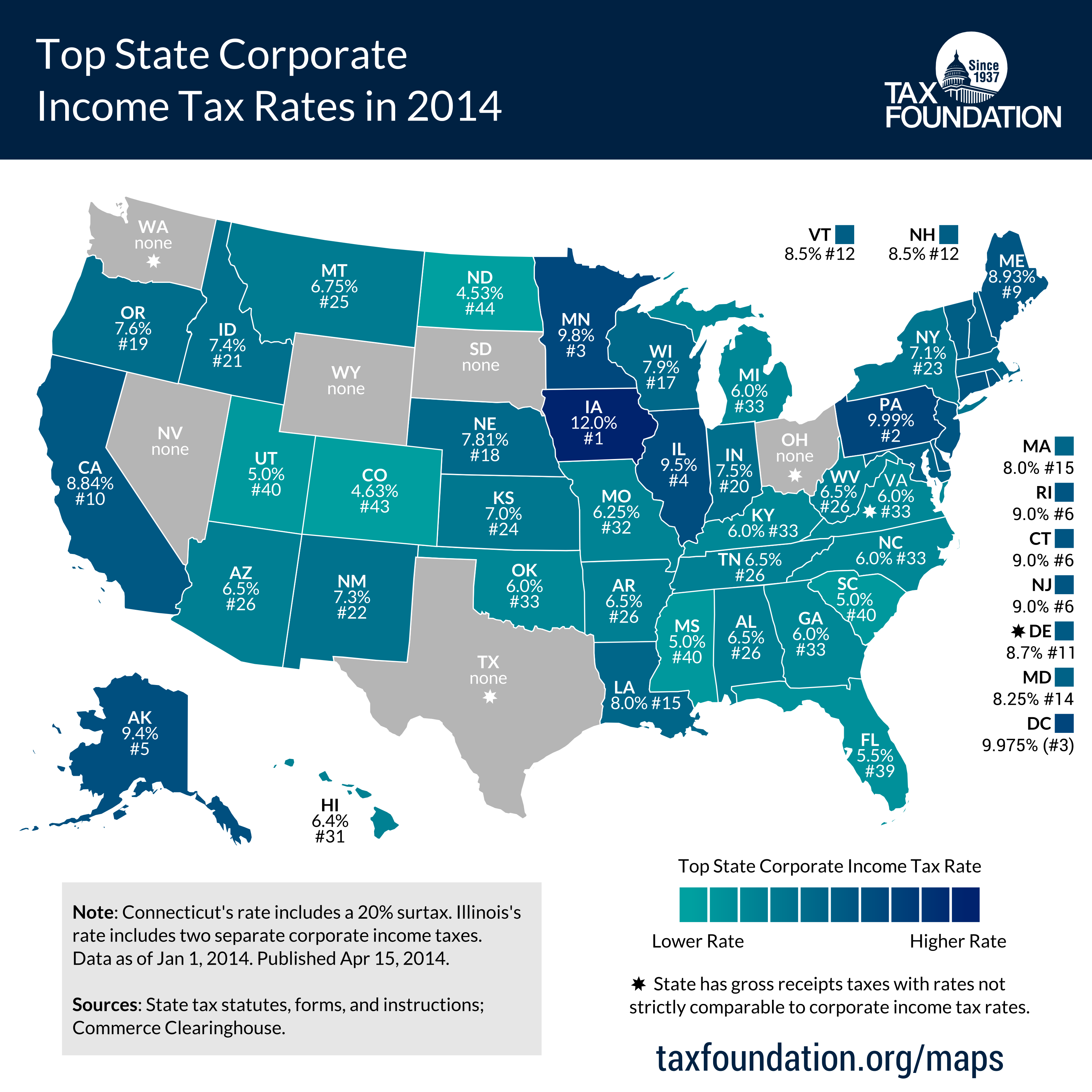

State Corporate Income Tax Rates and Brackets for 2021 Key Findings Forty-four states levy a corporate income tax. 2021 State Income Tax Rates and Brackets. Alabama a b c 200 0.

Six statesAlaska Illinois Iowa Minnesota New Jersey and Pennsylvania levy top marginal corporate income tax rates of 9 percent or higher. He offers a detailed understanding of state personal and corporate income taxation and trends across all states and has been quoted in top media. Maine tax forms are sourced from the Maine income.

The chart also shows if the state has a flat tax rate meaning only one rate of tax applies regardless of the wages paid or alternatively the highest marginal withholding rate according to the states latest computer withholding formula. State Individual Income Tax Rates and Brackets 2021 Single Filer Married Filing Jointly Standard Deduction Personal Exemption. The 2022 state personal income tax brackets are updated from the Mississippi and Tax Foundation data.

The following map shows a list of states by income tax rate for 2021. This weeks map examines states rankings on the individual income tax component of the 2021 State Business Tax Climate IndexThe individual income tax is important to businesses because states tax sole proprietorships partnerships and in most cases limited liability companies LLCs and S corporations under the individual income tax code. Mississippi Income Tax Rate 2020 - 2021.

10 Most Tax Friendly States For Retirees Retirement Advice Retirement Tax

Mississippi Tax Rate H R Block

States With Highest And Lowest Sales Tax Rates

State Income Tax Rates Highest Lowest 2021 Changes

State By State Guide To Taxes On Retirees Retirement Income Income Tax Tax Free States

State Corporate Income Tax Rates And Brackets Tax Foundation

Mississippi Tax Rate H R Block

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

Tax Friendly States For Retirees Best Places To Pay The Least

Top State Corporate Income Tax Rates In 2014 Tax Foundation

The States Where People Are Burdened With The Highest Taxes Zippia

Tax Rates Exemptions Deductions Dor

How Do State And Local Individual Income Taxes Work Tax Policy Center

The Most And Least Tax Friendly Us States

Missouri Income Tax Rate And Brackets H R Block

There Are 9 Us States With No Income Tax But 2 Of Them Still Tax Investment Earnings Business Insider India

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)