irvine property tax rate

The statistics from this question refer to the total amount of all real estate taxes on the entire. While paying property taxes isnt particularly fun the revenue.

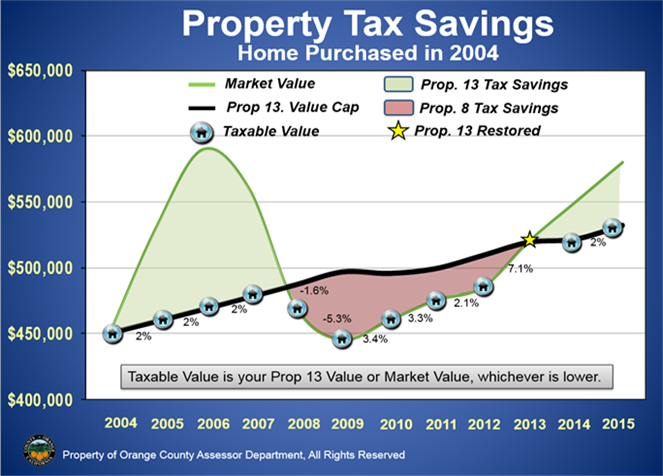

Declines In Market Value Orange County Assessor Department

Irvine Property Taxes Range Irvine Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount You may not be aware.

. Link is external PDF Format Change of Address for Tax Bill. The Office of the Tax Collector is responsible for collecting taxes on all secured and unsecured property in Orange County. Review and pay your property taxes online by eCheck using your bank account no cost or a credit card 229 convenience fee with a minimum charge of.

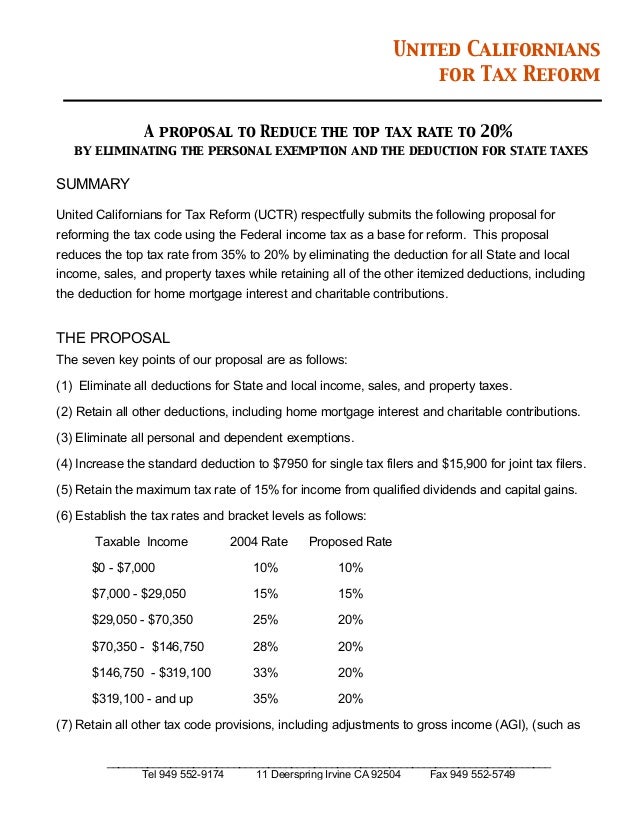

775 725 for State Sales and Use Tax 05 for Countywide Measure M Transportation Tax Property Tax Rate Use the Property Tax Allocation Guide School District Bond Rate School. After July the penalty increases 1 percent. This compares well to the national average which currently sits at 107.

Orange County collects on average 056 of a propertys assessed. Thanks to Prop 13 California has among the lowest property tax rates in the US. For every 1000 of a homes value Irvine residents can expect to pay 832 in property taxes.

The Irvine property tax rate is 1061. The following chart shows average annual property tax rates for each Orange County city for a 3-bedroom single family home. These companies paid the most but provided just a fraction of Orange Countys property tax revenue.

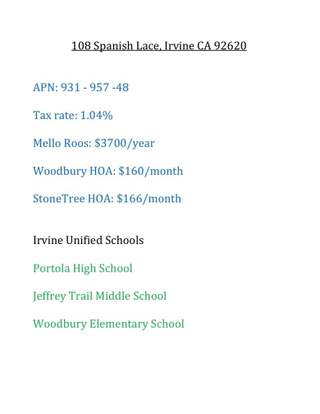

Irvine is located in Orange County and residents pay a median 7097 each year in property. However be aware that there are many Mellos-Roos. The median property tax in Orange County California is 3404 per year for a home worth the median value of 607900.

How Property Taxes in California Work. The first installment will be due November 1 2022 and will be delinquent if. 26-000 irvine city 255 27-000 mission viejo city 275 28-000 dana point city 280 29-000 laguna niguel city 286.

Irvine Property Taxes Range Irvine Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Maybe you arent. Across Orange County the median home value is 652900 and the median amount of property taxes paid annually is 4499. Total rate applicable to.

1 results in a penalty of 6 percent plus 1 percent per month until July 1 when the penalty becomes 12 percent. California Property Taxes Go To Different State 283900 Avg. Failure to pay these taxes before Feb.

Pay Your Property Taxes Online. Please note that this is the base tax rate without special. Claim for Refund of Taxes Paid.

Online payments will be unavailable during this time. The 2022-23 Property Tax bills are scheduled to be mailed the last week of September 2022. 074 of home value Tax amount varies by county The median property tax in California is 283900 per year for a home.

The following data sample includes all owner-occupied housing units in Irvine California. County of orange tax rate book. For everybody in the county total property taxes billed in 2021-22 were.

For questions about various tax rates please contact any of our local real estate agents here in. This office is also responsible for the sale of property subject to. The website will be undergoing maintenance on September 18 2022 from 700 AM to 1200 PM PST.

The average effective property tax rate in California is 073. We highly recommend you satisfy and verify for yourself that actual tax rate of any given property.

Property Taxes Madison County Sheriff S Office Kentucky

Where Are The Lowest Property Taxes In Florida Mansion Global

Orange County Ca Property Tax Calculator Smartasset

Prop 15 How It Affects Commercial Property Tax Rate In California

Orange County Property Tax Oc Tax Collector Tax Specialists

These New York Counties Have The Highest Property Taxes In America

Measure To Add Tax On Property Sales Over 5m Set For November Ballot

Orange County Homes With No Mello Roos Orange County Mello Roos Properties

108 Spanish Lace Irvine Ca 92620 Mls Ar22108955 Redfin

Irvine Ca Cost Of Living Is Irvine Affordable Data Tips Info

Orange County Tax Administration Orange County Nc

The Not So Ugly Truth About Mello Roos Taxes On Irvine Homes For Sale

Property Tax Orange County Tax Collector

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/7988729/homeowners_2017_2_map.png)

Boston A Top City To Be A Homeowner Report Says Curbed Boston

113 Frontier Irvine Ca 92620 Realtor Com

Property Tax Oc Treasurer Tax Collector

How Much Is Property Tax In California Caris Property Management